Anchorage CRE Market Q2 2025: Low Vacancy, Rising Rents, Strong Investment Activity

Anchorage Market Report: Q2 2025 Trends & Insights

Anchorage Commercial Real Estate Market Report – Q2 2025

Anchorage entered Q2 2025 with stable economic momentum. Key industries such as oil and tourism continued to support growth, and major investments in transportation infrastructure and hospitality upgrades signaled optimism in the commercial market. While housing affordability remains a regional challenge, the commercial landscape has shown resilience and steady demand, particularly in the industrial and retail sectors.

Key Market Metrics Overview

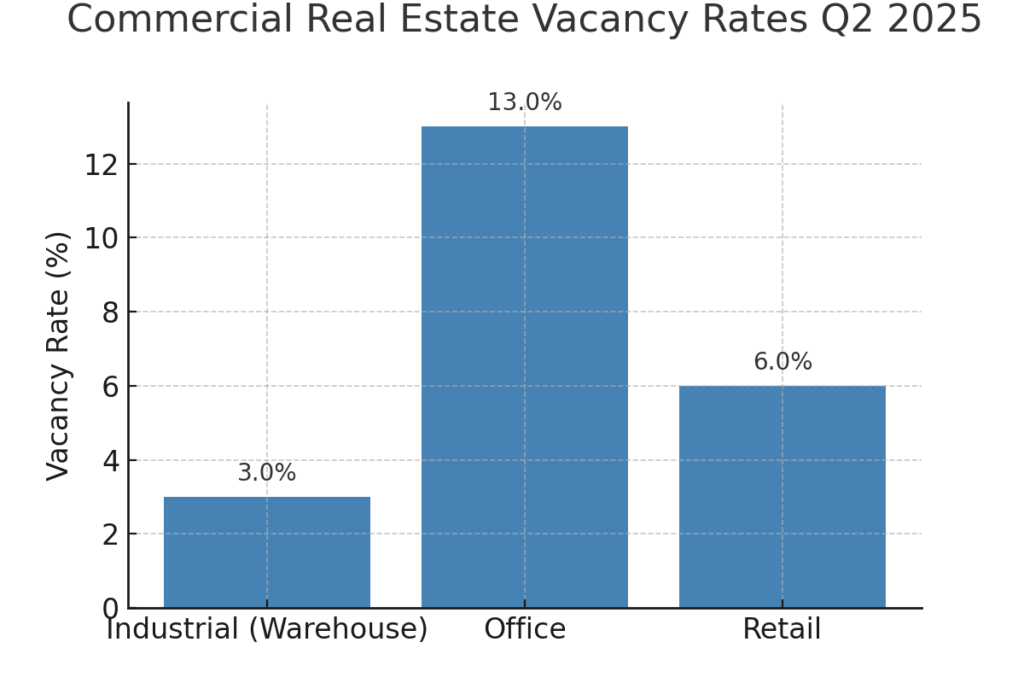

- Office Vacancy: ~12–13%, with positive net absorption in Class A properties

- Retail Vacancy: Low single digits, strong tenant demand

- Industrial Vacancy: <1%, some of the lowest in the nation

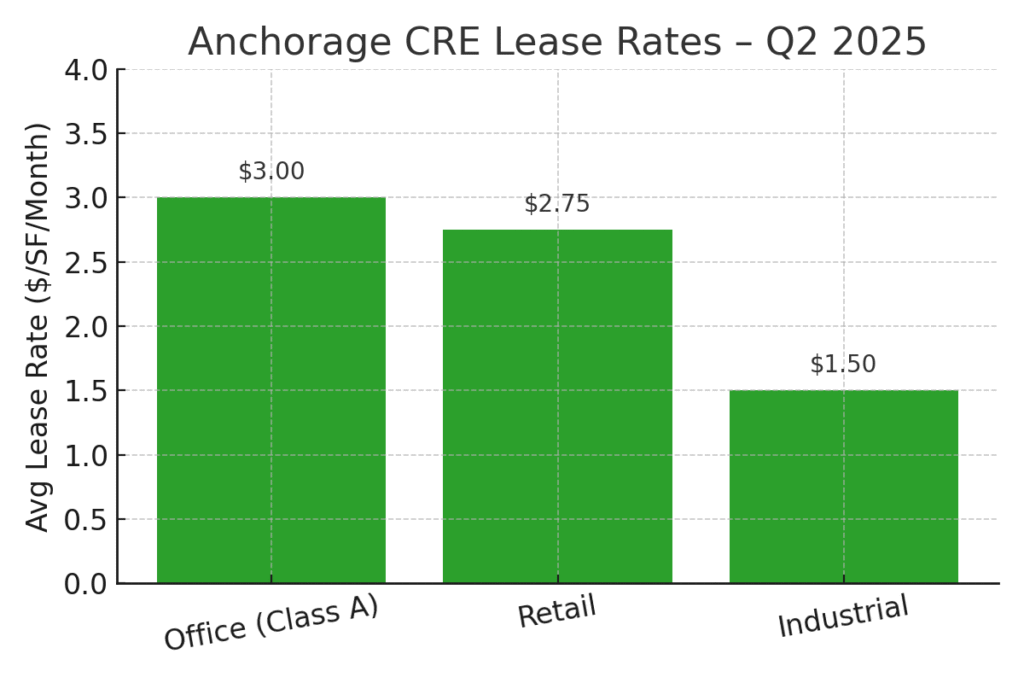

- Rental Rates: Increasing across all commercial sectors, especially industrial

- Notable Activity: Downtown renovations, airport area industrial expansion, South Anchorage retail development

Office Sector Trends

The office sector in Anchorage continued its uneven recovery in Q2. Demand for Class A office space remained stable, driven by companies seeking high-quality environments for hybrid teams. Lease rates for these spaces held strong, averaging $2.75–$3.25/SF/month full service. In contrast, older Class B and C buildings saw elevated vacancies and pressure on rents, prompting concessions from landlords.

Tenants are particularly interested in mid-sized office footprints (3,000–6,000 SF), with modest positive net absorption this quarter. The bifurcation between premium and dated office stock is now more pronounced than ever, as remote work trends push companies toward efficient, well-located space. The outlook for the office market is cautiously optimistic, with further stabilization expected as business activity grows.

Retail Sector Trends

Retail performance in Anchorage during Q2 was strong. Consumer spending rose thanks to increased incomes and a busy early summer tourism season. Retail vacancy remained in the low single digits, with service-oriented businesses and experiential retail driving demand.

Prime retail locations have seen multiple tenants competing for space, with lease rates remaining stable or trending slightly upward. Landlords are expanding and renovating assets, particularly in areas like South Anchorage and the 4th Avenue corridor downtown. While early-season hotel occupancy showed a slight dip, the cruise season ramped up quickly, benefiting retailers near key traffic zones.

Industrial Sector Trends

The industrial sector continues to outperform. Vacancy rates fell below 1%, reflecting the chronic undersupply of warehouse and logistics space. Lease rates have reached historic highs, with newer high-clearance warehouses commanding $1.35–$1.65/SF/month triple net. Older stock also saw increased demand and rent growth.

Tenant activity was led by logistics, trades, and construction-related businesses, particularly those supporting airport cargo operations and regional distribution. Industrial properties remain highly attractive to investors, with cap rates tightening and values reaching record levels. Limited new supply and high replacement costs ensure that industrial space will remain in demand through the rest of the year.

Multifamily & Investment Property Trends

Although not the core focus for commercial brokers, the tightness in Anchorage’s multifamily sector has an indirect effect on commercial trends. Ultra-low residential vacancy (sub-2%) and rising rents continue to make mixed-use and multifamily investments appealing. Investor competition remains high for income-producing properties, and despite limited transaction volume, values continue to rise.

Economic & Regulatory Influences

Anchorage is expected to add over 3,000 jobs in 2025, led by construction, cargo logistics, and tourism. New development incentives and discussions around zoning reform aim to ease constraints on commercial and mixed-use projects.

Capital availability remains relatively stable, although interest rates continue to be a watchpoint for investors. Financing remains accessible, though underwriting standards have tightened. The city’s emphasis on infrastructure upgrades and downtown revitalization bodes well for long-term CRE value.

Outlook for Q3 and Beyond

Q2 confirmed that Anchorage’s CRE market is defined by high demand and constrained supply. Industrial remains the most competitive segment, while retail continues to see strength in service and experience-based formats. Office demand is normalizing, particularly for efficient Class A space.

For investors and business owners, the environment remains favorable for long-term plays—especially in logistics, mixed-use development, and income-producing assets. The second half of 2025 will be shaped by continued economic expansion, interest rate stability, and the pace of new development coming online.

Conclusion

Anchorage’s commercial real estate market is showing resilience and opportunity. For investors looking to position ahead of supply-demand shifts, now is the time to engage. For a deeper look into market opportunities or asset positioning, reach out to Ingram Alaska Commercial Real Estate.

Sources:

- Anchorage Economic Development Corporation

- Local brokerage reports (Q2 2025)

- Alaska Journal of Commerce

- Zillow, Redfin, Realtor.com (indirect market pressures)

- U.S. Census & Labor Statistics (regional job growth)

- NAR Commercial Reports (CRE sector data)

- Anchorage Daily News and other local media outlets