Alaska’s 2026 Economic Forecast: Your Most Important Trends to Watch in the Coming Year

Executive Summary

The economic narrative for Anchorage and the broader state of Alaska in 2026 is one of resilience, transformation, and distinct duality. As we move deeper into the latter half of the decade, the state finds itself at a critical intersection of legacy resource extraction and modern logistical dominance. For commercial real estate investors, business owners, and stakeholders, Alaska’s 2026 Economic Forecast offers a complex mix of high-yield opportunities in industrial and workforce housing sectors, balanced against structural challenges in the office market and state fiscal policy.

This comprehensive report serves as a definitive guide to the economic trends shaping Alaska in 2026. We move beyond surface-level statistics to examine the causal relationships driving market behavior. From the massive capital injections on the North Slope to the granular shifts in Anchorage’s retail leasing corridors, this analysis provides the actionable intelligence required to navigate a year defined by tentative optimism and strategic pivoting.

The forecast for 2026 is characterized by a “two-speed” economy. The industrial and logistics sectors are accelerating rapidly, fueled by record-breaking air cargo volumes and the construction phases of major energy projects like Willow and Pikka. Conversely, consumer confidence faces headwinds from cumulative inflation and housing affordability issues, creating a more cautious environment for discretionary retail and hospitality. Understanding this bifurcation is essential for deploying capital effectively in the coming year.

Section 1: Macro-Economic Drivers and State Fiscal Health

The performance of local commercial real estate is inextricably linked to the broader economic machinery of the state. In 2026, that machinery is being driven by federal policy, global energy demand, and the internal fiscal dynamics of the Alaska State Legislature.

1.1 The Inflationary Hangover and Consumer Sentiment

While national inflation rates have moderated, Anchorage continues to grapple with the compounding effects of price increases over the last five years. The forecast for 2026 predicts a local inflation rate of approximately 2.5 percent. While this figure appears manageable in isolation, it sits atop a high base level established during the post-pandemic surges. This persistent high cost of living has a direct dampening effect on consumer sentiment.

Research from the Anchorage Economic Development Corporation (AEDC) indicates that consumer confidence has dipped to its lowest level in a decade. This metric is critical for retail landlords. When confidence in the “local economy” and “future expectations” hits all-time lows, households tend to pull back on large discretionary purchases. However, a nuanced look at the data reveals that “personal finance confidence” remains in an optimistic range. This divergence suggests that while Alaskans are anxious about the macro-political and economic stability of the state, they feel relatively secure in their own employment and income streams.

For the commercial real estate sector, this manifests as a stable but price-sensitive tenant base. Retail centers anchored by essential services – grocery, medical, and discount goods – are insulated from this sentiment, while luxury goods and high-end dining may face stronger headwinds.

1.2 The State Fiscal Cliff and ISER Analysis

Uncertainty regarding the state budget continues to cast a shadow over long-term investment. The Institute of Social and Economic Research (ISER) released a pivotal report in January 2026 detailing the fiscal options available to the state as it confronts a structural deficit. The report underscores that the state’s reliance on volatile oil revenues and the earnings of the Permanent Fund creates a “fiscal cliff” scenario that lawmakers must address to ensure stability.

The ISER analysis evaluated various measures to balance the budget, including spending cuts, reductions to the Permanent Fund Dividend (PFD), and new taxes. Crucially for the business community, the report concluded that raising taxes on businesses and oil companies would historically have the lowest negative impact on aggregate jobs and income compared to the alternatives. Cutting state services or the PFD was found to have a more severe contractionary effect on the economy because these cuts directly reduce the disposable income of residents who spend locally.

Governor Mike Dunleavy’s proposed fiscal plan for 2026 attempts to thread this needle by introducing a statutory spending cap and revising the PFD formula to a 50/50 split, aiming to provide a rules-based system that avoids the annual “boom-and-bust” political cycle. For commercial property owners, the resolution of this fiscal debate is paramount. A stable state budget correlates directly with government leasing activity and the ability of municipalities to fund services without resorting to drastic property tax hikes.

1.3 Federal Policy and Regional Divergence

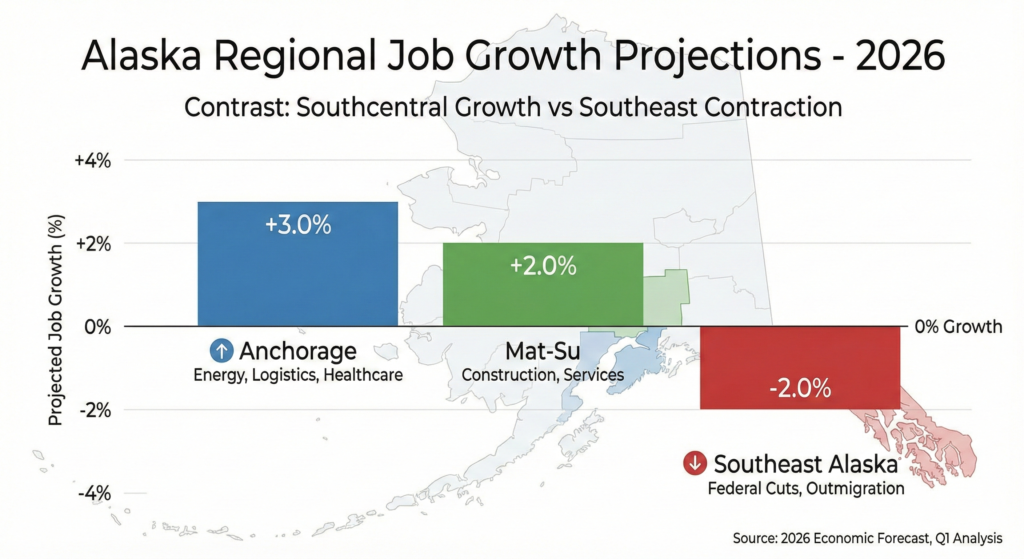

A major trend for 2026 is the growing economic divergence between Southcentral Alaska and the Southeast region. The new federal administration’s push to shrink the federal workforce is having a disproportionate impact on Juneau and Southeast communities, where federal employment is a significant economic driver. Forecasts indicate negative job growth for Southeast Alaska in 2026 as federal payrolls contract and outmigration continues.

In contrast, Anchorage and the Mat-Su Borough are somewhat insulated by the dominance of private sector energy and logistics activity. This regional decoupling suggests that Anchorage will increasingly consolidate its position as the economic engine of the state, potentially drawing labor talent migrating from the contracting Southeast region.

Section 2: The Energy Renaissance

The most bullish signal for the 2026 economy is the resurgence of major North Slope energy projects. After years of regulatory delays and uncertainty, capital is finally flowing into the ground, creating a ripple effect of demand for engineering, logistics, and support services in Anchorage.

2.1 Pikka and Willow: From Planning to Production

Two major projects are anchoring this resurgence: the Pikka project and the Willow project.

The Pikka Project Operated by Santos, the Pikka project is transitioning from a capital-intensive construction phase to an operational production phase in early 2026. This transition is a critical milestone. While construction jobs typically peak and then decline, production jobs provide long-term stability. The commencement of oil production at Pikka adds new volume to the Trans-Alaska Pipeline System (TAPS), improving the unit economics of the pipeline and generating royalty revenue for the state.

The Willow Project ConocoPhillips’ Willow project is in the thick of its construction boom in 2026. This massive development in the National Petroleum Reserve-Alaska (NPR-A) is estimated to produce 180,000 barrels of oil per day at its peak. For 2026, the primary economic impact is the employment of thousands of construction workers and the procurement of materials. The project is projected to create 2,500 construction jobs and supports a vast supply chain.

Crucially, the revenue implications of Willow are being recalibrated. A 2025 report from the Alaska Department of Revenue lowered the expected state treasury net from Willow to $2.6 billion through 2053, a significant reduction from previous estimates. This is largely due to oil tax credits and deductions that allow producers to write off development costs against production taxes. While this dampens the direct fiscal benefit to the state treasury in the short term, the private sector impact through wages, vendor contracts, and secondary spending, remains a massive stimulus for the Anchorage economy.

2.2 The Alaska LNG Pivot

Perhaps the most significant “wildcard” for the 2026 forecast is the Alaska LNG project. The narrative surrounding this project has shifted from skepticism to tentative execution. The project developer, Glenfarne Group, has made substantial progress in structuring the deal, moving Phase One into early execution.

Phase One: Domestic Gas Focus The strategic shift to split the project into two phases has de-risked the initial development. Phase One focuses on constructing the 42-inch pipeline to bring North Slope gas to Southcentral Alaska to meet domestic energy needs. This addresses the looming energy crisis in the Cook Inlet basin, where local gas supplies are dwindling.

Strategic Agreements

In late 2025 and early 2026, Glenfarne announced several definitive agreements that signal project viability:

- EPCM Contract: Worley Limited has been provisionally named to provide Engineering, Procurement, and Construction Management services.

- Commercial Offtake: Agreements with Asian buyers, including POSCO International Corporation, have secured a portion of the LNG offtake required for financing Phase Two.

- Mining Power: A Letter of Intent with Donlin Gold suggests that the pipeline could also supply natural gas to power the massive Donlin Gold mine project in Western Alaska, creating a secondary industrial customer to anchor the pipeline’s economics.

Implications for Real Estate The AEDC has explicitly stated that a positive Final Investment Decision (FID) on the LNG project would “substantially change” the economic forecast. If the project proceeds fully, it would trigger a boom cycle reminiscent of the 1970s pipeline construction era. Speculative land banking in industrial zones and accelerated demand for corporate housing are already visible as savvy investors position themselves for this potential upside.

Section 3: Logistics and Infrastructure Dominance

While energy grabs the headlines, the logistics sector provides the steady baseline load for the Anchorage economy. The city’s geographic advantage – equidistant between major industrial centers in Asia, Europe, and North America – continues to drive investment.

3.1 Air Cargo Expansion

Ted Stevens Anchorage International Airport (ANC) solidified its status as a global cargo hub in 2025, handling a record-breaking 3.82 million tonnes of air cargo. This volume is not merely passing through; it is generating local economic activity.

Third-Party Logistics (3PL) Growth The “Amazon effect” has taken root in Anchorage. The demand for “last-mile” delivery services is reshaping the industrial landscape. In 2025, the transportation sector added 550 jobs, many in courier and local delivery services, with another 450 jobs forecast for 2026. This growth is driven by consumer expectations for rapid delivery, necessitating local warehousing of high-velocity goods.

New Passenger Dynamics A major development for the hospitality and tourism sector is the entry of Southwest Airlines into the Anchorage market. Beginning in May 2026, Southwest will offer daily flights connecting Anchorage to hubs like Denver and Las Vegas. This new capacity does two things:

- Lowers Costs: Competition typically compresses airfares, making Alaska a more attractive destination for budget-conscious tourists.

- Increases Volume: Southwest’s massive domestic network feeds directly into Anchorage, potentially boosting summer visitor numbers which supports hotel occupancy and downtown retail foot traffic.

3.2 Port of Alaska Modernization

The Port of Alaska, which handles the vast majority of goods entering the state, also set volume records in 2025 with 5.7 million tonnes crossing the docks. The modernization program is critical infrastructure work that ensures food security and supply chain resilience. The increased activity at the port drives demand for nearby industrial laydown yards and cold storage facilities, particularly as the seafood industry adapts to changing global supply chains.

Section 4: Commercial Real Estate Market Analysis

With the macro-economic stage set, we turn to the specific performance metrics for Anchorage’s commercial real estate sectors. The 2026 market is defined by a flight to quality in office, extreme scarcity in industrial, and an evolution in retail.

4.1 Industrial Real Estate: The Landlord’s Market

Status: Strong Seller’s Market

Vacancy: < 4.0% (Near Historic Lows)

Lease Rates: $1.25 – $1.65+ / SF / Month (NNN)

The industrial sector remains the crown jewel of the Anchorage commercial market. The convergence of North Slope project support, air cargo expansion, and e-commerce distribution has created a supply-demand imbalance that firmly favors property owners.

Vacancy and Absorption Vacancy rates for functional industrial space are effectively zero in prime corridors. Properties under 20,000 square feet with dock-high loading and modern clear heights are seeing multiple offers immediately upon listing. The scarcity is most acute in the Ship Creek and South Anchorage submarkets, where zoning allows for the intense use required by logistics operators.

Rent Growth Dynamics Lease rates have broken through historical resistance levels. Class A industrial space is commanding rates in the mid-$20s per square foot annually on a triple-net basis. Tenants, faced with the alternative of having no operational footprint in the state, are absorbing these costs. We are also observing a rise in “blended” lease rates for Flex properties such as buildings that combine showroom or office frontage with rear warehouse space, which are trading at a premium due to their versatility for local service businesses.

The Development Dilemma

Despite high rents, speculative construction remains limited. High construction costs and a shortage of suitable I-1/I-2 zoned land in the Anchorage Bowl make new development risky. This suggests that existing assets will continue to appreciate in value as replacement costs soar.

4.2 Office Market: The Great Bifurcation

Status: Tenant’s Market / Stabilizing

Vacancy: ~10.6% (Class A) to 15%+ (Class C)

Lease Rates: Flat ($2.10/SF Class A vs $1.70/SF Class B)

The office market in 2026 tells a tale of two cities. While overall vacancy statistics might suggest weakness, a deeper look reveals a “flight to quality” that is insulating the top end of the market.

Class A vs. The Rest Tenants are taking advantage of soft market conditions to upgrade their space. Companies are moving from older Class B buildings into Class A towers in Downtown and Midtown, often reducing their total square footage but paying a higher rate per square foot for better amenities. This consolidation is stabilizing Class A vacancy around 10.6%, while leaving older, energy-inefficient buildings with significant vacancies.

Medical Office Resilience A bright spot in the office sector is medical real estate. With healthcare projected to drive a third of the state’s job growth in 2026, demand for clinical space is robust. Medical office buildings (MOBs), particularly those near the Providence/Alaska Regional hospital corridors, are performing exceptionally well, often achieving 100% occupancy and long-term lease commitments that traditional office assets cannot match.

Significant Transactions A notable trend in 2026 is the shift of public entities towards ownership. The Municipality of Anchorage completed the purchase of its City Hall headquarters, ending decades of leasing. This move saves the city money in the long run but removes a major tenant requirement from the leasing pool. Similarly, the acquisition of hotels for patient lodging by the Alaska Native Tribal Health Consortium demonstrates how the medical sector is repurposing commercial assets to meet housing needs.

4.3 Retail Market: Adaptation and Resilience

Status: Balanced

Vacancy: ~5.7%

Lease Rates: Steady ($1.62/SF/Month average)

Retail in Anchorage has largely rightsized following the post-pandemic adjustments. The market in 2026 is characterized by a stable vacancy rate of roughly 5.7% and a shift toward service-oriented tenants.

The Experience Economy

Vacancies left by traditional soft-goods retailers are being backfilled by “experiential” tenants – fitness centers, entertainment venues, and dining. These businesses are internet-resistant and drive foot traffic that benefits co-tenants.

Lease Rate Trends

Retail rents vary significantly by location and asset quality.

- Prime Neighborhood Centers: Grocery-anchored centers command rents in the high teens to mid-$20s per square foot (NNN).

- Secondary Locations: Strip centers in less trafficked areas are seeing softer rents (low teens), with landlords offering concessions to attract local tenants.

Seasonality and Structure Most retail leases in Anchorage are structured as Triple-Net (NNN), passing the costs of snow removal, taxes, and utilities to the tenant. Given the inflationary pressure on these operating expenses, tenants are increasingly scrutinized for their ability to absorb these variable costs.

4.4 Multifamily and Housing: The Critical Bottleneck

Status: Undersupplied / Landlord’s Market

Vacancy: < 4% (Projected)

Cap Rates: 6.25% – 7.75%

The single greatest constraint on the Anchorage economy in 2026 is housing. The lack of affordable, quality housing is hindering labor mobility and preventing companies from filling open positions.

Supply Constraints New housing construction remains anemic. In 2024, only an estimated 237 units were permitted, far below the 500+ units needed annually to keep pace with demand and replace obsolete stock. High interest rates and construction costs have made private multifamily development difficult to pencil out.

Innovative Solutions

To bridge this gap, agencies like the Alaska Housing Finance Corporation (AHFC) and Cook Inlet Housing Authority (CIHA) are stepping in.

- AHFC Initiatives: The “Last Frontier Housing Initiative” has exceeded expectations, bringing new units online faster and under budget. New legislative programs in 2026 are expanding AHFC’s ability to partner with landholders to develop workforce housing.

- CIHA Development: Cook Inlet Housing Authority continues to be a primary developer of affordable units. Their 2026 projects, such as the Baxter Family Housing development, utilize job training programs to simultaneously build homes and train the next generation of construction tradespeople.

Investment Outlook For investors, existing multifamily assets are incredibly valuable. With replacement costs far exceeding market values, buying and renovating older 1980s stock offers a compelling value-add strategy. Cap rates for smaller multiplexes (4-12 units) are hovering in the 6.5% – 7.75% range, offering decent cash flow in a high-demand rental market.

Section 5: Detailed Data Forecasts

5.1 2026 Commercial Lease Rate Matrix

The following table provides a reference range for asking lease rates in Anchorage for 2026. These figures represent base rents and do not include NNN expenses, which can add significant cost.

| Asset Class | Sub-Type | Estimated Base Rent (Annual / SF) | Monthly Equivalent (/SF) | Trend |

| Industrial | Class A Warehouse | $18.00 – $24.00 (NNN) | $1.50 – $2.00 | Strong Increase |

| Industrial | Class B / Older Stock | $14.00 – $17.00 (NNN) | $1.15 – $1.40 | Moderate Increase |

| Office | Class A (Downtown) | $25.00 – $34.00 (Full Service) | $2.10 – $2.85 | Stable |

| Office | Class B (Midtown) | $19.00 – $23.00 (Full Service) | $1.60 – $1.90 | Softening |

| Retail | Prime Grocery Anchor | $24.00 – $30.00 (NNN) | $2.00 – $2.50 | Stable |

| Retail | Unanchored Strip | $15.00 – $20.00 (NNN) | $1.25 – $1.65 | Softening |

| Multifamily | Market Rate (2-Bed) | $1,500 – $1,900 / Month | N/A | Increase |

Data synthesized from market reports and listing trends.

5.2 Employment Growth Projections by Sector (2026)

| Sector | Outlook | Primary Drivers |

| Healthcare | High Growth | Aging population; regional hub demand |

| Oil & Gas | Moderate Growth | Pikka production start; Willow construction |

| Transportation | High Growth | 3PL logistics; air cargo; new airline routes |

| Construction | Moderate Growth | Federal infrastructure; military projects |

| Tourism | Moderate Growth | Cruise capacity +20%; new flight capacity |

| Federal Govt | Decline | Budget cuts targeting federal workforce |

| Retail Trade | Flat | Consumer inflation fatigue; efficiency gains |

Section 6: Strategic Scenarios and Investment Guidance

Given the volatility inherent in a resource-based economy, we recommend viewing the 2026 market through the lens of two potential scenarios.

Scenario A: The “Full Steam” Bull Case

- Trigger: Glenfarne Group announces a fully funded Final Investment Decision (FID) for Alaska LNG Phase 2 in late 2026.

- Implication: This would trigger an immediate repricing of all real estate assets in Southcentral Alaska. Industrial land would become gold dust. Housing demand would spike violently as speculative migration begins.

- Investor Strategy: Acquisition of land banks and value-add multifamily properties. Hold assets for capital appreciation.

Scenario B: The “Federal Drag” Bear Case

- Trigger: Aggressive federal budget cuts significantly reduce transfer payments to Alaska; oil prices dip, causing state budget contraction.

- Implication: The “fiscal cliff” becomes a reality. The state may be forced to push tax burdens to municipalities. Office vacancy rises as government contractors consolidate.

- Investor Strategy: Defensive positioning. Focus on “recession-proof” tenants (medical, grocery). Lock in long-term leases with credit tenants. Avoid discretionary retail and Class B office space.

6.1 Actionable Advice for Business Owners

- Lock Your Rate: If you are a tenant in an industrial building, your leverage is diminishing. Secure long-term renewals now before vacancy drops further.

- Evaluate NNN Exposure: With inflation running at 2.5% on top of previous highs, scrutinize the operating expenses in your lease. Energy efficiency upgrades can directly lower your occupancy costs in a NNN structure.

- Workforce Housing: Large employers should consider direct intervention in housing, either through master-leasing units for employees or partnering with developers. The labor shortage is a housing shortage; solving one solves the other.

Conclusion

The 2026 economic landscape for Alaska is a study in adaptation. The state is successfully pivoting from a pure extraction economy to a diversified logistics and energy hub. While challenges remain, specifically regarding the state budget and housing inventor, the fundamental drivers of the economy are robust.

For the commercial real estate investor, 2026 is a year for precision. The days of broad market appreciation are paused; success now comes from identifying the specific sub-sectors (industrial logistics, workforce housing, medical office) that are aligned with the state’s structural growth engines. By monitoring the key dates – Pikka first oil in March, Southwest’s arrival in May, and the LNG decision in late 2026, stakeholders can position themselves to capitalize on the unique opportunities of the High North.

About this Report: This document was compiled by the Research & Strategy Division for the purpose of guiding commercial real estate investment and leasing decisions in the Alaska market. All forecasts are based on data available as of Q1 2026.

Works cited

- The 2026 economic forecast for Anchorage isn’t looking bright – YouTube, accessed February 3, 2026, https://www.youtube.com/watch?v=d68OuppK4U4

- AEDC Forecast Tentative, Pending LNG Decision – Alaska Business …, accessed February 3, 2026, https://www.akbizmag.com/featured/aedc-forecast-tentative-pending-lng-decision/

- 2025 Economic Forecast – AEDC – Anchorage Economic Development Corporation, accessed February 3, 2026, https://aedcweb.com/report/2025-economic-forecast/

- Institute of Social and Economic Research: Home, accessed February 3, 2026, https://iseralaska.org/

- Raising oil, corporate taxes is least-painful option for reducing Alaska deficits, ISER concludes, accessed February 3, 2026, https://alaskapublic.org/news/economy/2026-01-30/raising-oil-corporate-taxes-is-least-painful-option-for-reducing-alaska-deficits-iser-concludes

- Governor Dunleavy Introduces Fiscal Plan Legislation, accessed February 3, 2026, https://gov.alaska.gov/governor-dunleavy-introduces-fiscal-plan-legislation/

- Negative job growth forecast for Southeast Alaska in 2026 – Juneau Independent, accessed February 3, 2026, https://www.juneauindependent.com/post/negative-job-growth-forecast-for-southeast-alaska-in-2026

- Report shows negative job growth in Southeast due to federal layoffs, population decline, accessed February 3, 2026, https://www.ktoo.org/2026/01/07/report-shows-negative-job-growth-in-southeast-due-to-federal-layoffs-population-decline/

- Willow | ConocoPhillips Alaska, accessed February 3, 2026, https://alaska.conocophillips.com/what-we-do/projects/willow/

- Willow Project | ConocoPhillips, accessed February 3, 2026, https://www.conocophillips.com/operations/alaska/willow-project/

- New estimate projects 50% less Alaska state revenue from proposed Willow oil project, accessed February 3, 2026, https://alaskapublic.org/news/economy/energy/2025-09-12/new-estimate-projects-50-less-alaska-state-revenue-from-proposed-willow-oil-project

- Glenfarne Announces Major Phase One Alaska LNG Milestones, with Construction, Line Pipe Supply, and In-State Gas Agreements, accessed February 3, 2026, https://glenfarnegroup.com/glenfarne-announces-major-phase-one-alaska-lng-milestones-with-construction-line-pipe-supply-and-in-state-gas-agreements/

- Glenfarne, Posco International Corporation Finalize Strategic Alaska LNG Partnership and Project’s First HOA, accessed February 3, 2026, https://glenfarnegroup.com/glenfarne-posco-international-corporation-finalize-strategic-alaska-lng-partnership-and-projects-first-hoa/

- Glenfarne and Donlin Gold Sign Letter of Intent for Alaska Gas and Infrastructure, accessed February 3, 2026, https://glenfarnegroup.com/glenfarne-and-donlin-gold-sign-letter-of-intent-for-alaska-gas-and-infrastructure/

- THE SUMMER WE TURNED PLENTY OF VACATION DREAMS INTO REALITY: BOOK SUMMER 2026 ON SOUTHWEST TODAY!, accessed February 3, 2026, https://www.southwestairlinesinvestorrelations.com/news-events/press-releases/detail/1898/the-summer-we-turned-plenty-of-vacation-dreams-into-reality-book-summer-2026-on-southwest-today

- To the Great Land! Southwest is Adding Anchorage, Alaska, to its Network in 2026, accessed February 3, 2026, https://www.swamedia.com/news-and-stories/news-release/to-the-great-land-southwest-is-adding-anchorage-alaska-to-its-network-in-2026-MC3FAHZGEOLBBBXJUWH5NOBEIAFM

- Alaska Department of Labor Publishes 2026 Jobs Forecast, accessed February 3, 2026, https://mustreadalaska.com/alaska-department-of-labor-publishes-2026-jobs-forecast/

- North America real estate market outlook Q4 2025 | Aberdeen Investments, accessed February 3, 2026, https://www.aberdeeninvestments.com/en-dk/institutional/insights-and-research/north-america-real-estate-market-outlook-q4-2025

- City Hall Sets Example for Anchorage Real Estate Resurgence – Alaska Business Magazine, accessed February 3, 2026, https://www.akbizmag.com/industry/real-estate-industry/city-hall-sets-example-for-anchorage-real-estate-resurgence/

- AEDC | Helping grow a prosperous, sustainable and diverse economy in Anchorage., accessed February 3, 2026, https://aedcweb.com/

- AHFC’s Innovative Housing Initiative Gains Ground Meeting Community Needs, accessed February 3, 2026, https://www.ahfc.us/blog/posts/ahfcs-innovative-housing-initiative-gains-ground-meeting-community-needs

- BAXTER FAMILY HOUSING PHASE I VERTICAL CONSTRUCTION, accessed February 3, 2026, https://www.cookinlethousing.org/wp-content/uploads/2025/04/ITB-25T-DV-119-Baxter-Family-Housing-Ph-I-Vertical-Construction_FINAL-1.pdf

- Final FY 2026 Defense Bill Includes 19 Sullivan Provisions, Prioritizes Alaska, accessed February 3, 2026, https://www.sullivan.senate.gov/newsroom/press-releases/final-fy-2026-defense-bill-includes-19-sullivan-provisions-prioritizes-alaska